Initial insights from eight of the 50+ topics in the full report

The 2022 Category Management study has taken place in extraordinary times when category management and supply chain security has taken centre stage.

Our global survey respondents gave their time in this particularly challenging period to contribute their insights to the study, for this we are ever grateful.

You can request the full report and read about;

- What differentiates category management performance; Leaders v Starters.

- link the adoption of key practices with the delivery of enhanced results.

- Share with you a set of specific recommendations to drive improvement for each topic covered. Register here to receive the full report at the end of October.

|

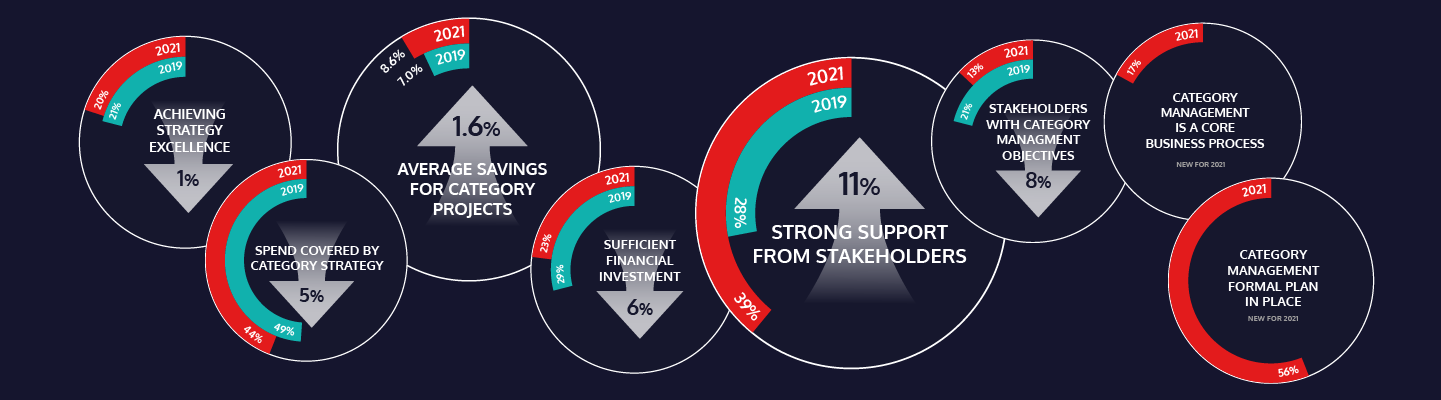

On average, 44% of spend is covered with category strategiesDown from 49% in the 2019-20 survey. Teams significantly impacted by the pandemic have been focused on the fundamentals such as assurance of supply. |

|

Average savings for category projects is 8.6%Up from 7.0% in the previous survey, respondents are driving more savings from each individual category project. This may have been driven by an increased focus on savings from business stakeholders. |

|

Only 20% believe that their strategies are excellentConsistent with the previous score of 21%, the overall quality of category strategies has not improved. This is a stubbornly low score and reflects the view that well written category strategies remain an aspiration rather than reality in many organisations. |

|

56% of respondents say they have a formal plan for adopting category managementThis is a new question prompted by consulting assignments over the past couple of years. The relative strength of the result suggest that most organisations have developed a structured plan, which is great to see. |

|

39% of respondents have strong support from stakeholdersThis score has increased significantly from 28% in the last survey, indicating that the value of category management is being increasingly well communicated to stakeholders by procurement teams. |

|

23% of organisations have sufficient financial investmentDespite having a formal plan and stronger stakeholder support, more than three-quarters of respondents have not secured the funding they believe is required to optimise category management. This is likely to be a key driver of the low scores for spend coverage and quality of strategies. This question scored 29% in 2019-20. |

|

13% of stakeholders have CatMan objectivesAlways an acid test question on how much category management is a business rather than functional process. It is all to rarely encountered, but where used, we have seen this power exceptional results. The score has dropped from 21% in 2019-20. |

|

Only 17% believe that Category management is a core business process adopted by stakeholders as well as procurementCollaboration between business stakeholders and procurement is at the heart of category management. It is an ongoing challenge to build and maintain cross-functional working as a core way of working and there is clearly still a long way to go. |

|

|